CURRENCY CONVERTER

CURRENCY CONVERTER

A reimagined and multibrand approach to Westpac Group’s currency converter

About the project

The Australian Competition & Consumer Commission (ACCC) mandated that all banks and foreign exchange providers need to be transparent to customers on all applicable fees when calculating sending money overseas. This was part of their Best Practice Guidelines with a hard compliance deadline of 29th March 2022.

We redesigned the currency converter to incorporate these fees and better suit the mental model when customers are sending money overseas.

Design team

Experience designer (me), visual designer, 2 UX researchers

Platform

Responsive Web, React JS

Tools

Miro, Figma, Axure

Timeline

Oct 2021 - Mar 2022

My role

I was the experience designer and collaborated really closely with the visual designer and researchers to work through the end to end process. I created user flows, wirefames, wrote research briefs, built prototypes, created design documentation on Confluence and was the main design stakeholder.

We worked within a cross functional team with a PO, developers, testers and closely with stakeholders from financial markets and global transaction services.

My process

Project kickoff Defining objectives, business goals, scope and timeline with stakeholders

Discovery Current state analysis, desktop research, stakeholder interviews

Explores, research and iterations How might we workshops, design jams, 1 round of usability testing

Final designs Collaboration with build team and PO, UX writing, final UX documentation, developer handover, brand reviews, compliance reviews

Launch Build support, QA and monitoring analytics post launch

Looking at the current state & competitors

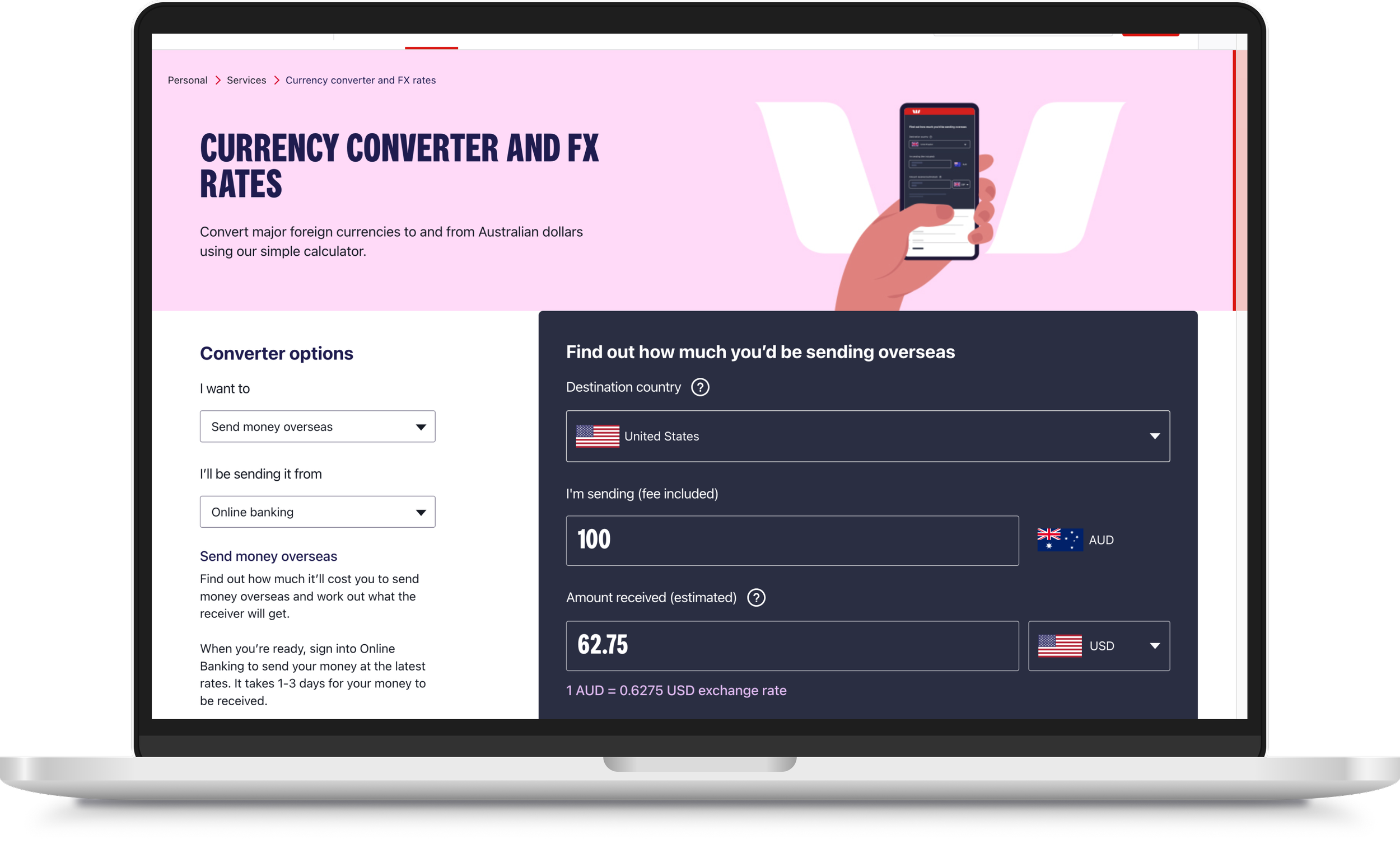

We had an existing currency convertor which was outdated and hadn’t been touched in years. There was no analytical tagging in place on the tool that could give us any behavioural insights to build on. The experience wasn’t built to be responsive and the mobile experience was horrible.

It had limited interaction and was non accessible. The exchange rate was also only updated once a day and was prone to errors due to the existing API.

I looked at a range of competitors in the market from Wise and XE to other banks; CommBank, ANZ and more. Main themes:

Most competitors had their exchange rate in a clear “1 AUD = 0.64 EUR” format

Use of flags, currency code, full currency and country name to help customer’s find the right currency

Current state

We conducted stakeholder interviews, had multiple requirements and analysis workshops then got straight into explores where we did rapid wireframing and designs.

How might we design a converter that allows customers to make easy comparisons and interpret fees in the most clear and transparent way?

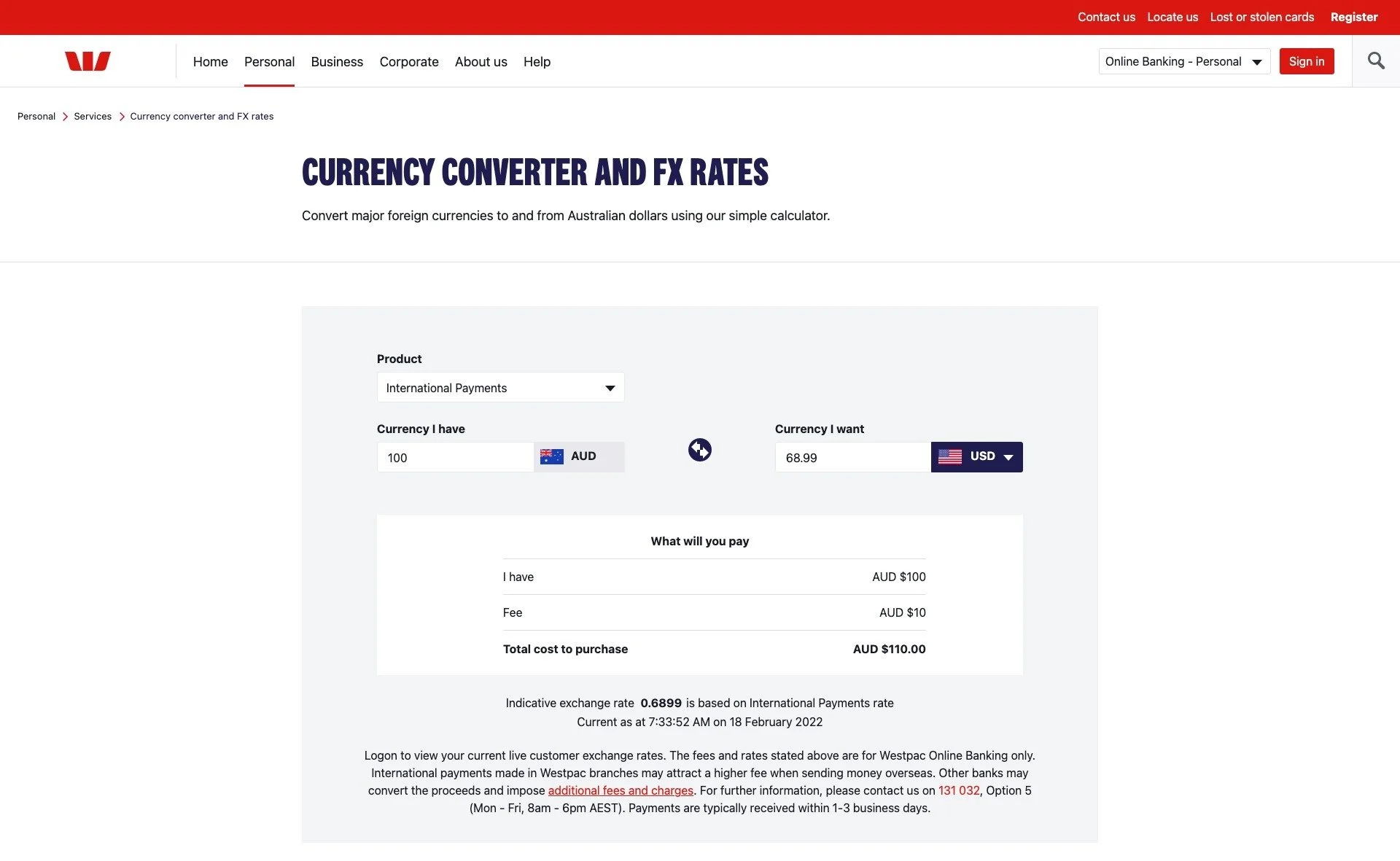

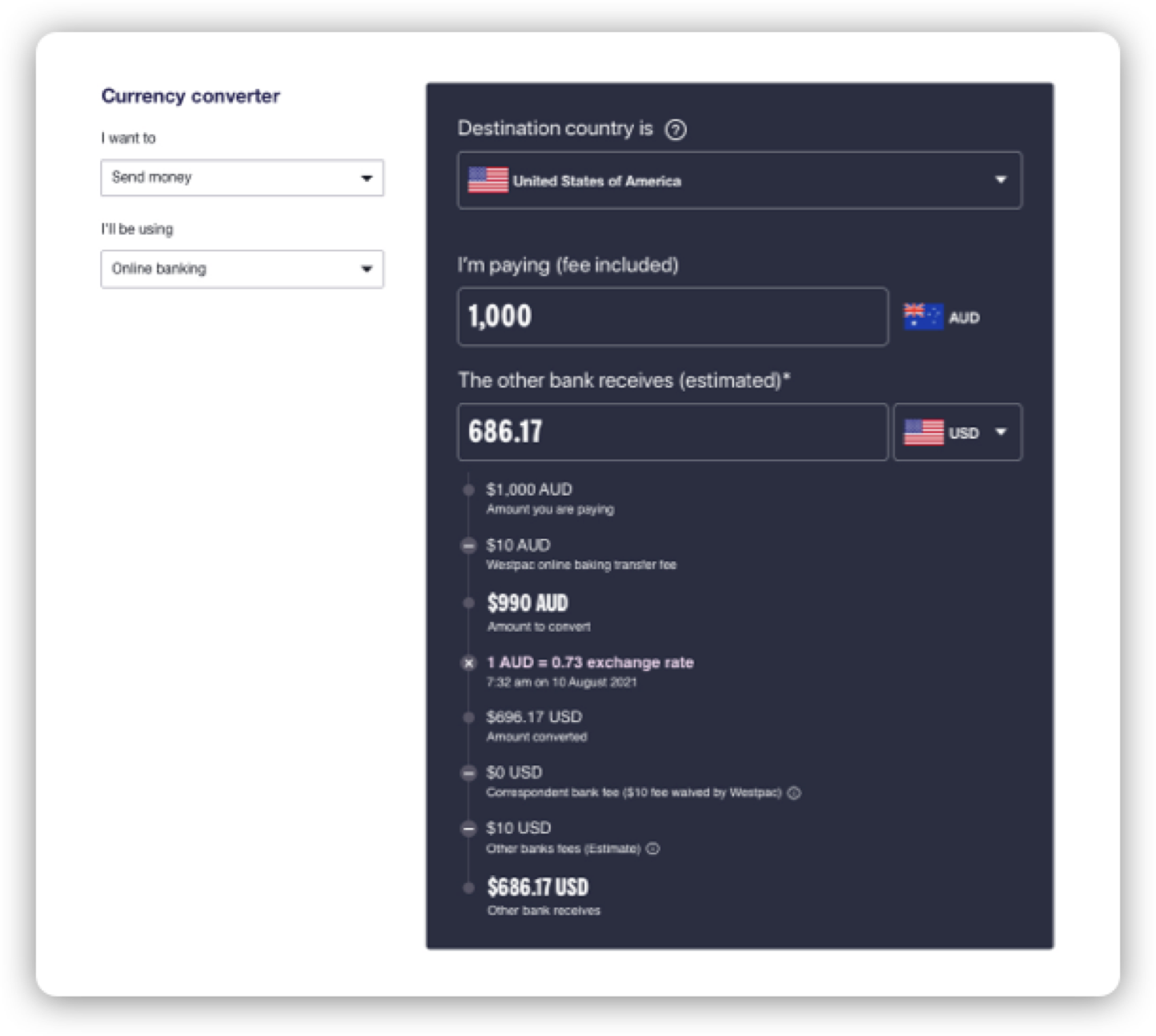

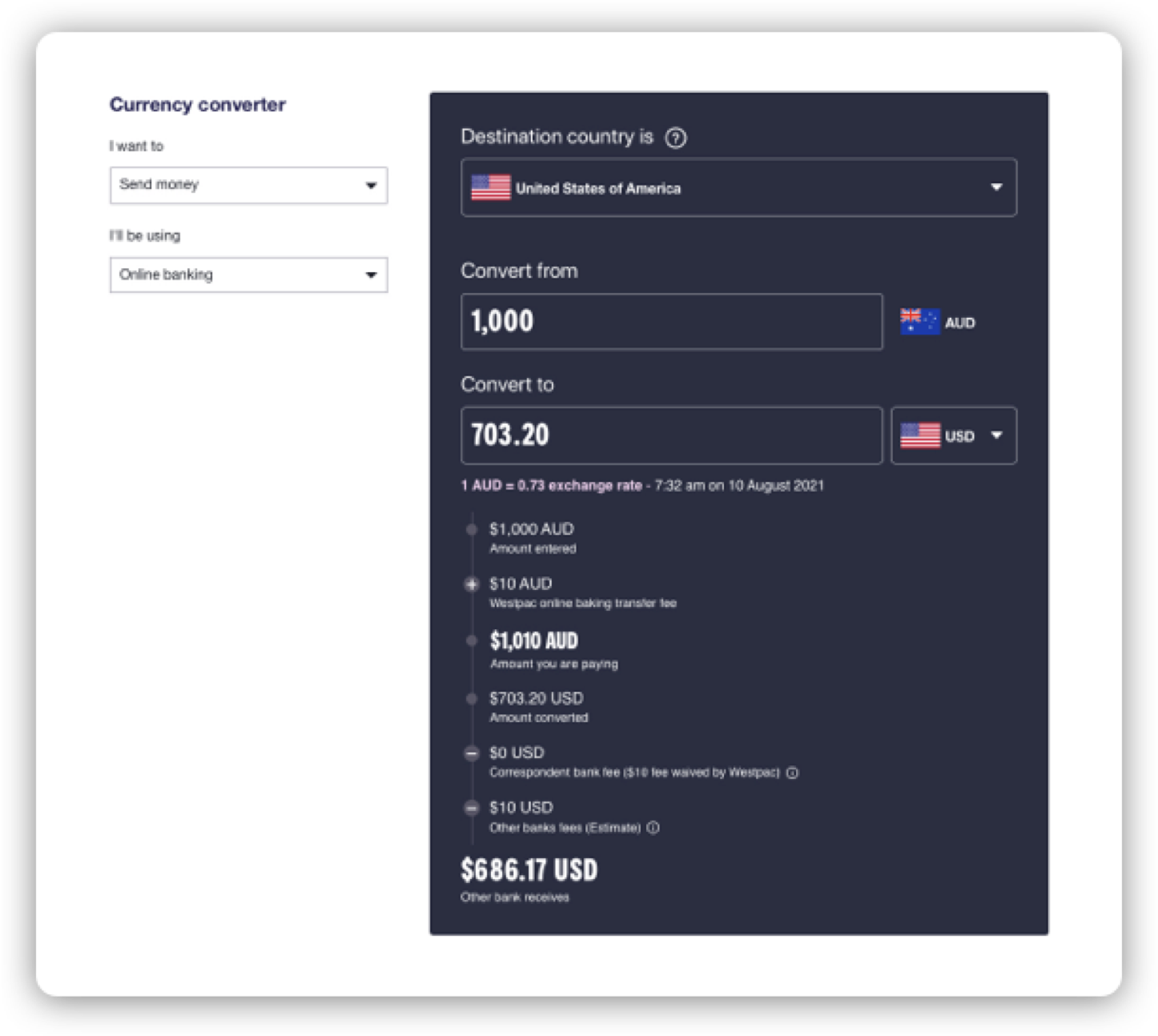

There were two mental models that came out from our explores; upfront calculation including fees (A) or conversion first then apply fees (B). Stakeholders thought that mental model B worked best for customers but our hypothesis was that mental model A provided more transparency and less mental math for the customer.

Mental model A

Mental model B

The journey to customer testing

Our biggest aim for usability testing was to validate what mental model worked best for our customers.

We ran a design jam and conducted a voting session with stakeholders and the wider design team to land on a design to take to testing. The visual designer worked on the hi-fidelity designs and handed them off to me to create the prototype in Axure.

You can check also out the prototype for yourself here in Axure. Password: FX2021

Key insights:

For personal, business and FX traders, all participants viewed exchange rates on XE.com and used that a basis of comparison across other banks and providers.

Majority of participants preferred mental model A with the resultants as it freed them from having to do any additional “mental math” to work out the final amount. This was a surprise for a lot of senior stakeholders who thought customer’s preferred a conversion first followed by the transaction breakdown.

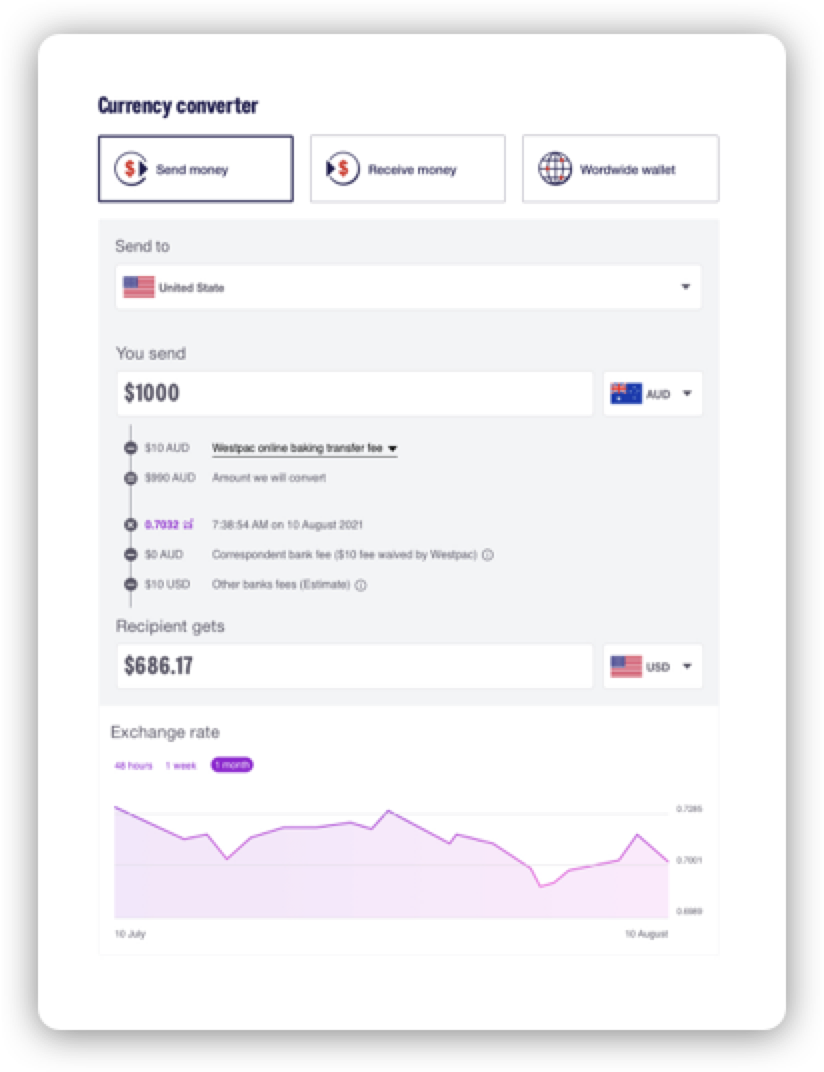

The rope design was also preferred by participants to display the transaction breakdown as it provided a sequential yet modern design.

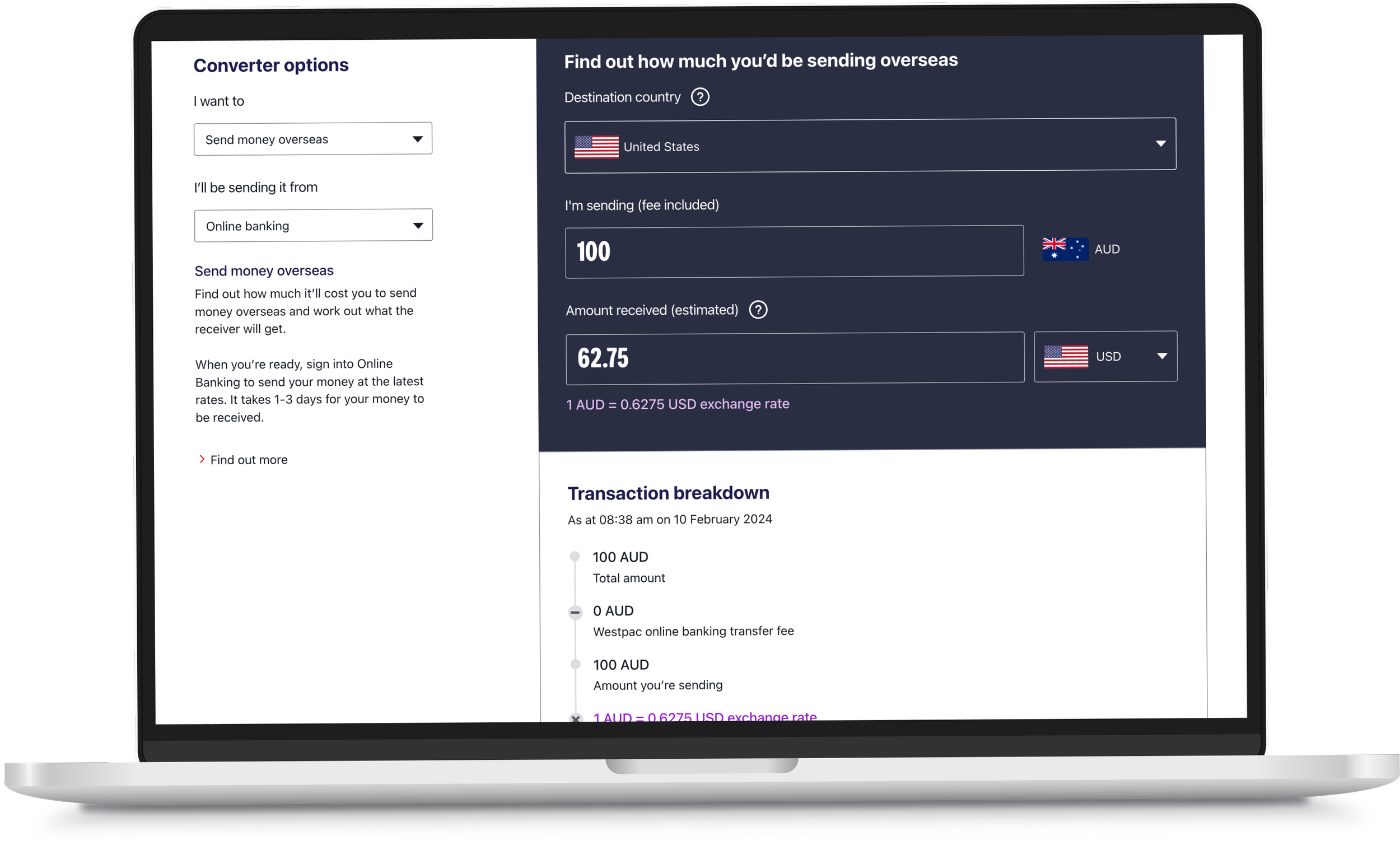

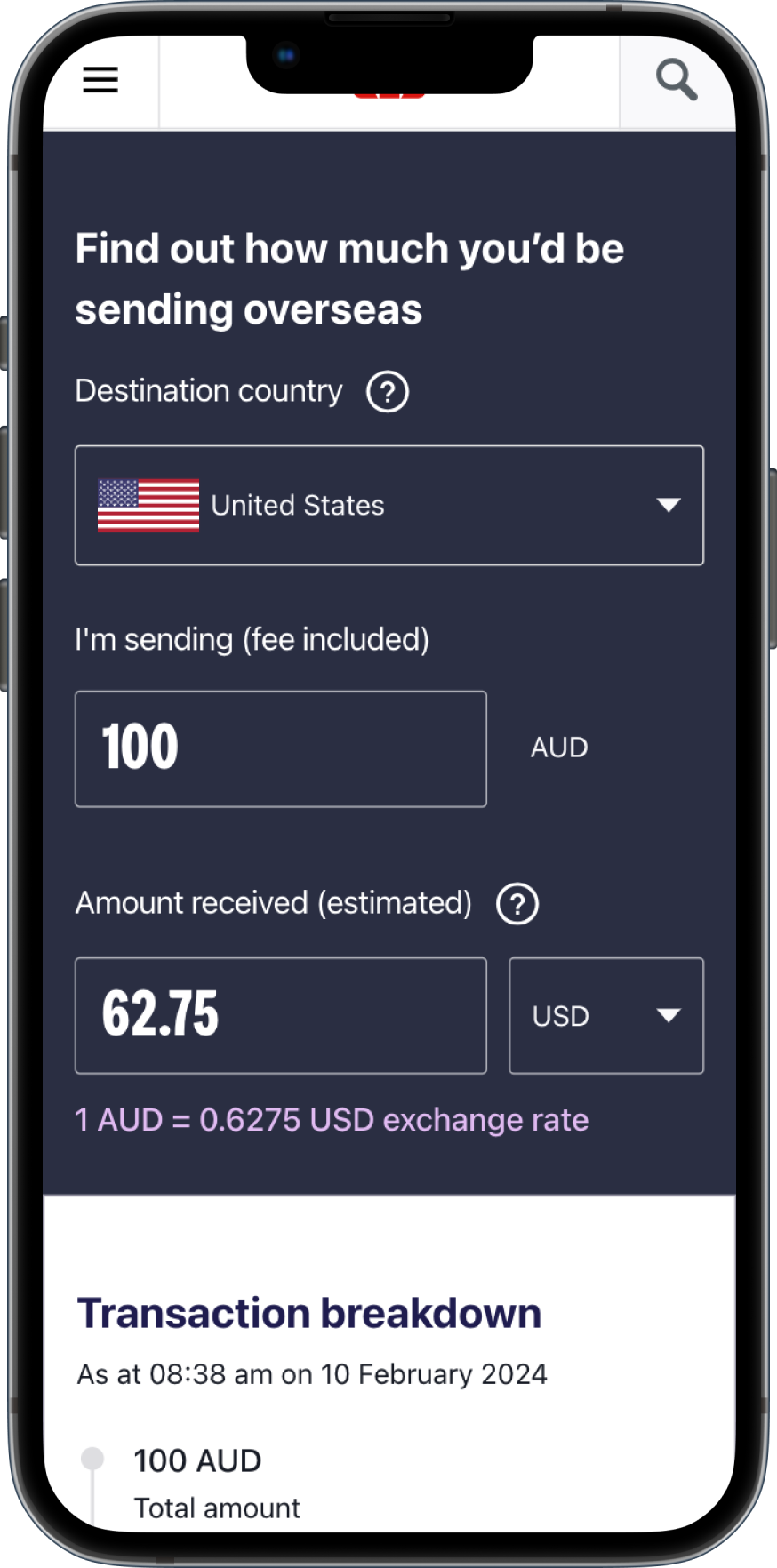

Final designs

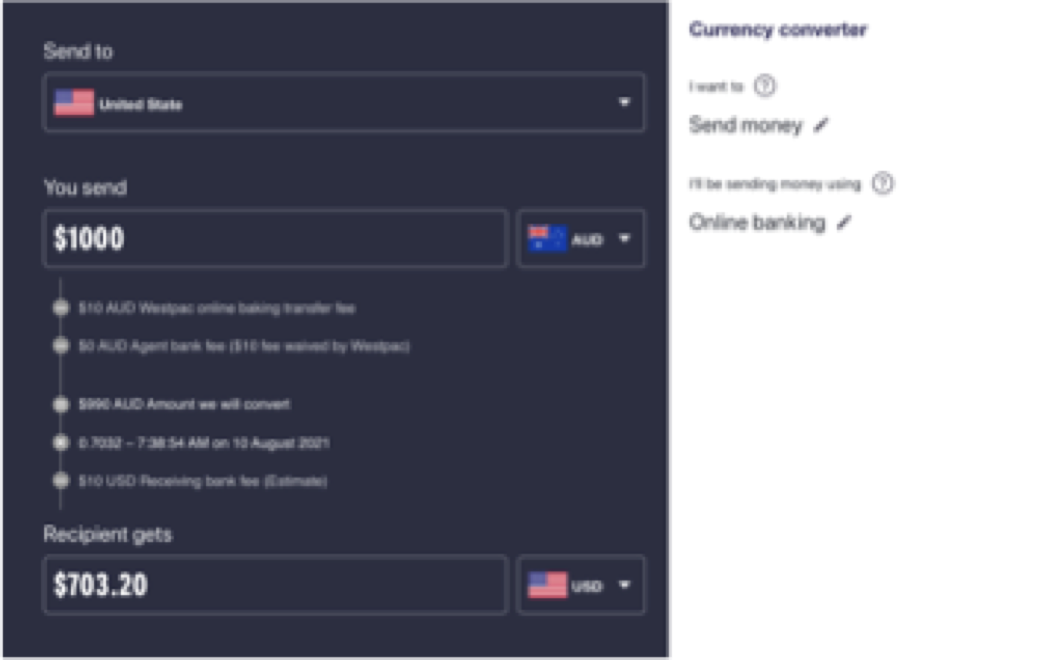

After usability testing we iterated on the designs and worked closely with developers.

Our final designs extended on the new calculator design language from the home loan calculators but this was the first time we took a multibrand approach.

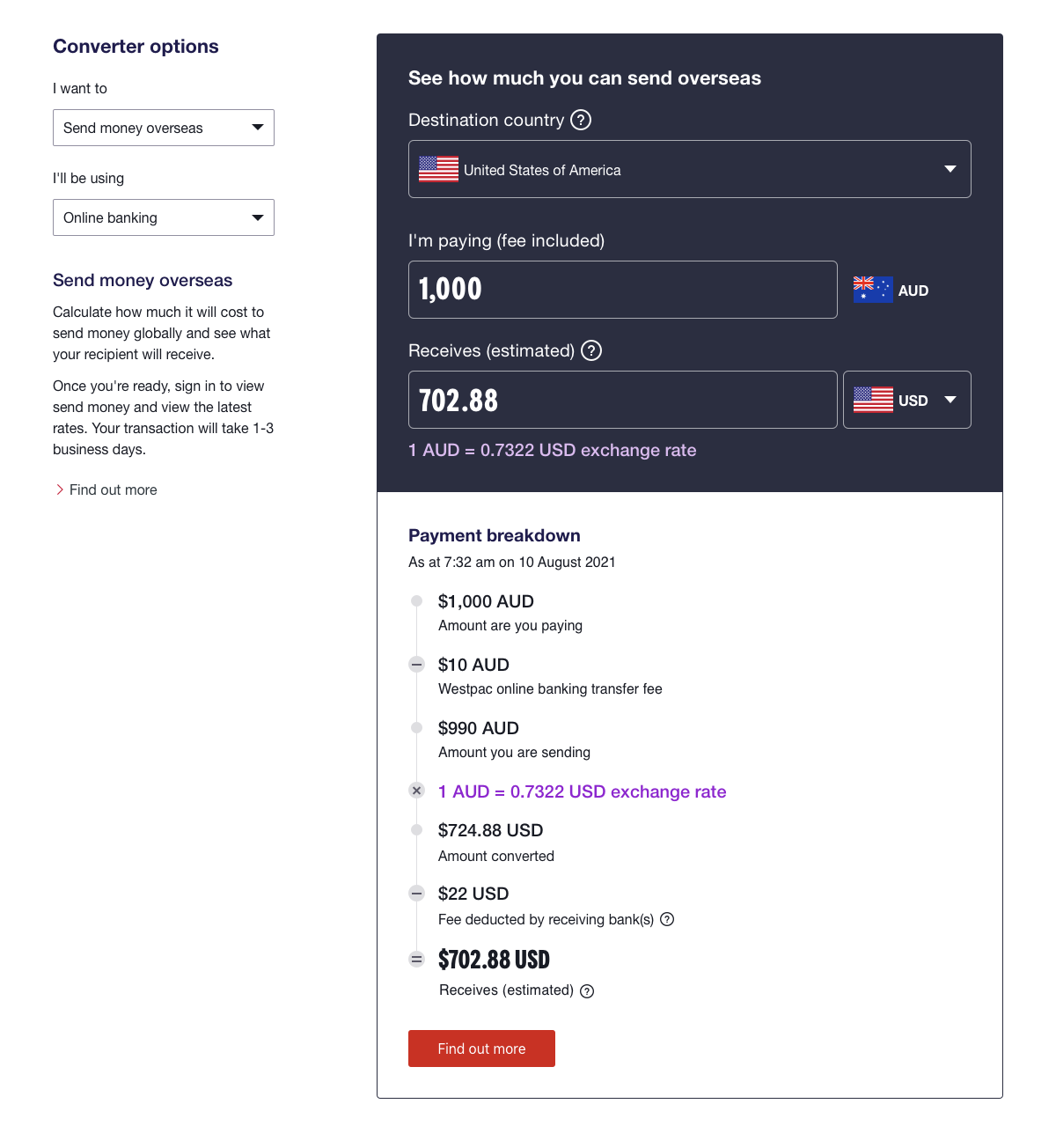

Westpac

Design principles

Natural language

Avoid banking jargon where possible, assume the user is a novice and provide explanations for any complex terminology, grounded in real life examples.

Playful and visual

Calculators should enable playful interactions, visually encouraging the user to manipulate the numbers with gestures. Beyond the written word.

Context over consistency

There is a cost to providing information that is not relevant to the user. We need to understand a user's context and consider this when selecting what content to display and the next steps available.

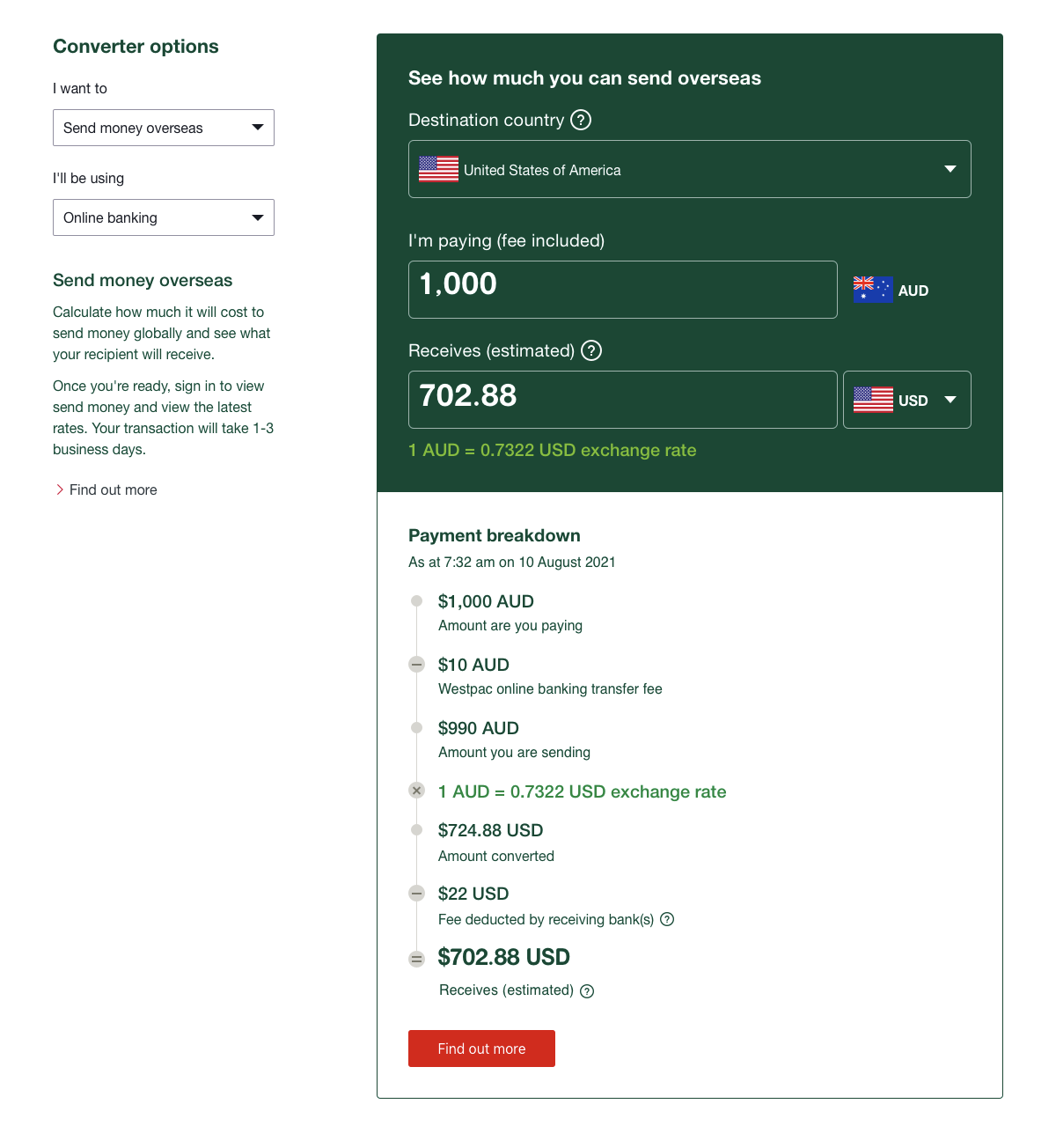

St. George

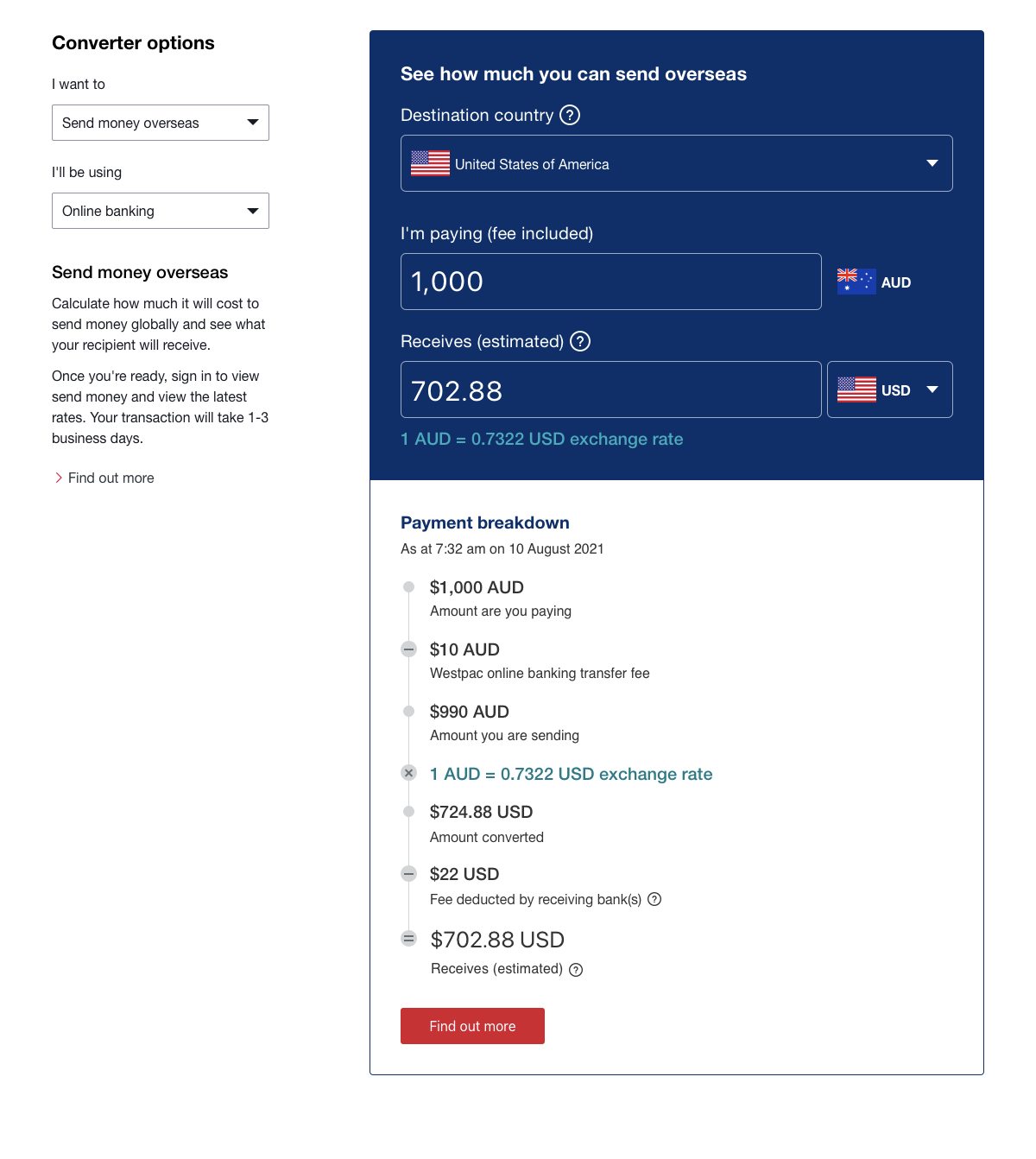

BankSA

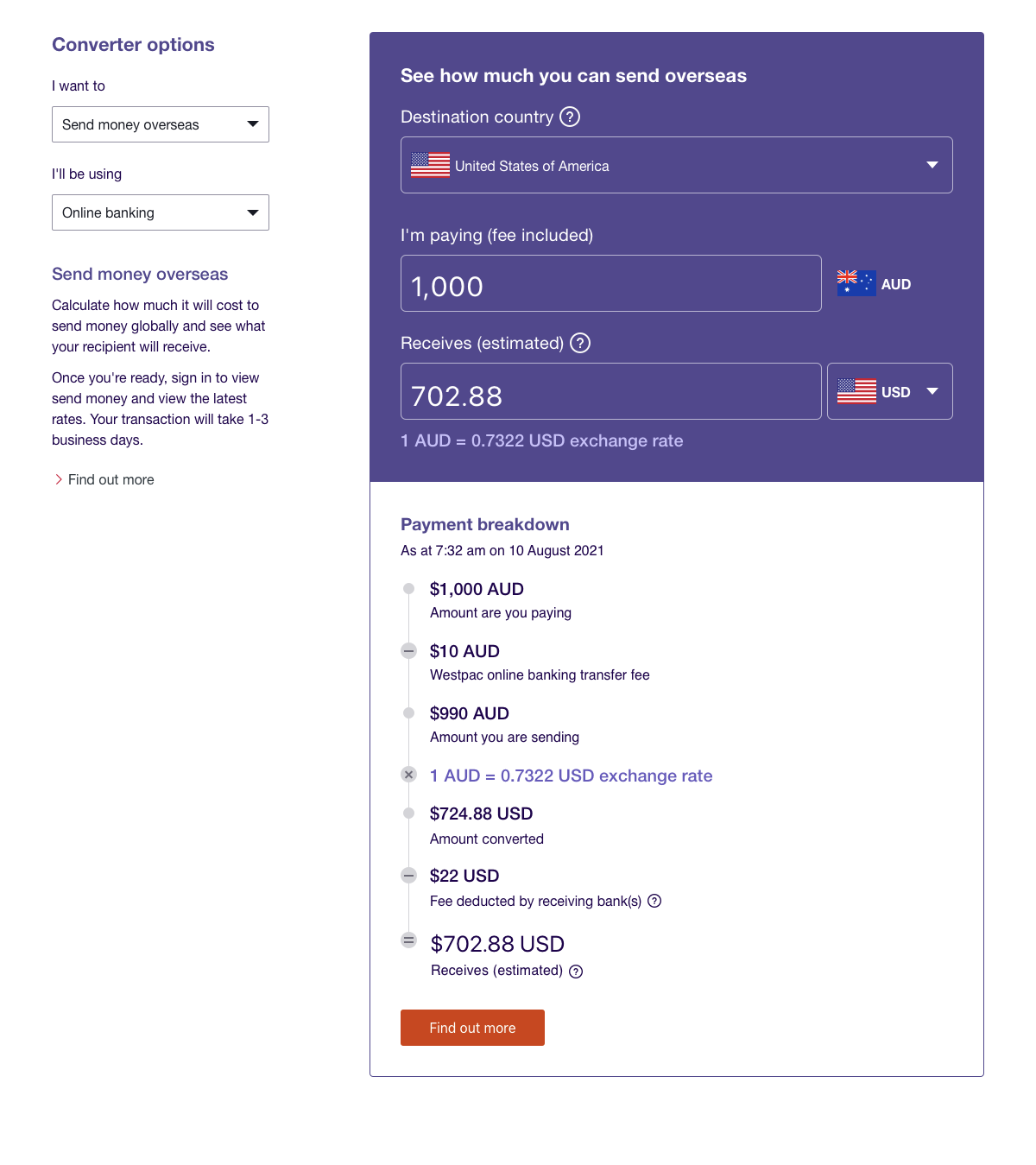

Bank of Melbourne

Learnings

Design advocacy was a key aspect of this project. We worked with a lot of senior stakeholders from Financial Markets and Global Transaction Services that are far removed from the digital world and aren’t familiar with the design process.

We started off this project being briefed by senior stakeholders with powerpoint mock ups of what they envisioned the currency convertor to look like and an expectation to deliver high fidelity designs in 1 sprint.

Through our advocacy, we bought 4 sprints worth of time to do discovery research, stakeholder interviews, design jams and commissioned 1 round of customer testing - which in a regulatory project with a tight deadline can be hard to achieve.

The outcome

Our currency convertor was delivered on time in March 2022 and we’ve had really positive customer feedback, shown by an uplift in page traffic and an increase in customer’s subscribing to our rate’s sheet.

Customer testing also provided the business stakeholders with insights to help review their pricing models and fees for international payments with the business reducing transfer fees for international payments.

See our new currency convertor for each of our brands: Westpac, St.George, Bank of Melbourne and BankSA.