SAVINGS GOALS

SAVINGS GOALS

Reimagining savings goals and helping customers build sustainable savings habits with the new Westpac mobile banking app.

About the project

It’s August 2020, we just got out of our first COVID-19 lockdown and Australian saving behaviours have drastically changed. Westpac is currently re-building the Mobile banking app to become a native iOS app and the neo banks are gaining significant market share.

Westpac introduces the Spend & Save campaign; a transactions and savings account dual offer with a 3% interest rate p.a - the leader in the market at the time. The business wanted a way to pilot this in the new Westpac app to rival the neo banks and help customers build healthy savings habits.

Design team

Senior experience designer, senior researcher, experience designer graduate (me) & visual designer

Platform

Mobile iOS and Android

Tools

Miro, Sketch, InVision

Timeline

Aug 2020 - Feb 2021

My role

I worked on this project during one of my graduate rotations as an experience designer and researcher. I ran workshops, did wireframes, UI explores, created InVision prototypes, wrote research discussion guides, performed exploratory research and usability testing, synthesised research insights, wrote and presented research reports.

My process

Project kickoff Defining objectives, business goals, scope and timeline with stakeholders

Discovery Current state analysis, desktop research, stakeholder interviews

Explores, research and iterations Multiple how might we workshops, design jams, 9 rounds of research (exploratory and usability testing), a round of quant research

Final designs Collaboration with build team and PO, final UX documentation, developer handover

Launch Build support, QA and monitoring analytics post launch

Project outcome

We launched the savings habits and goals feature in Feb 2021 as part of the wider Westpac new app launch and saw a positive change in the way customers were saving in our mobile banking app. Here are some key metrics 3 months after release:

40 - 50k new savings goals were created each month

Up from 20-30k in Nov 2020

450k funds transferred into goals from payments flows

Up from 365k in Nov 2020

6,000 new recurring payments into goals

Up from 2,100 in Nov 2020

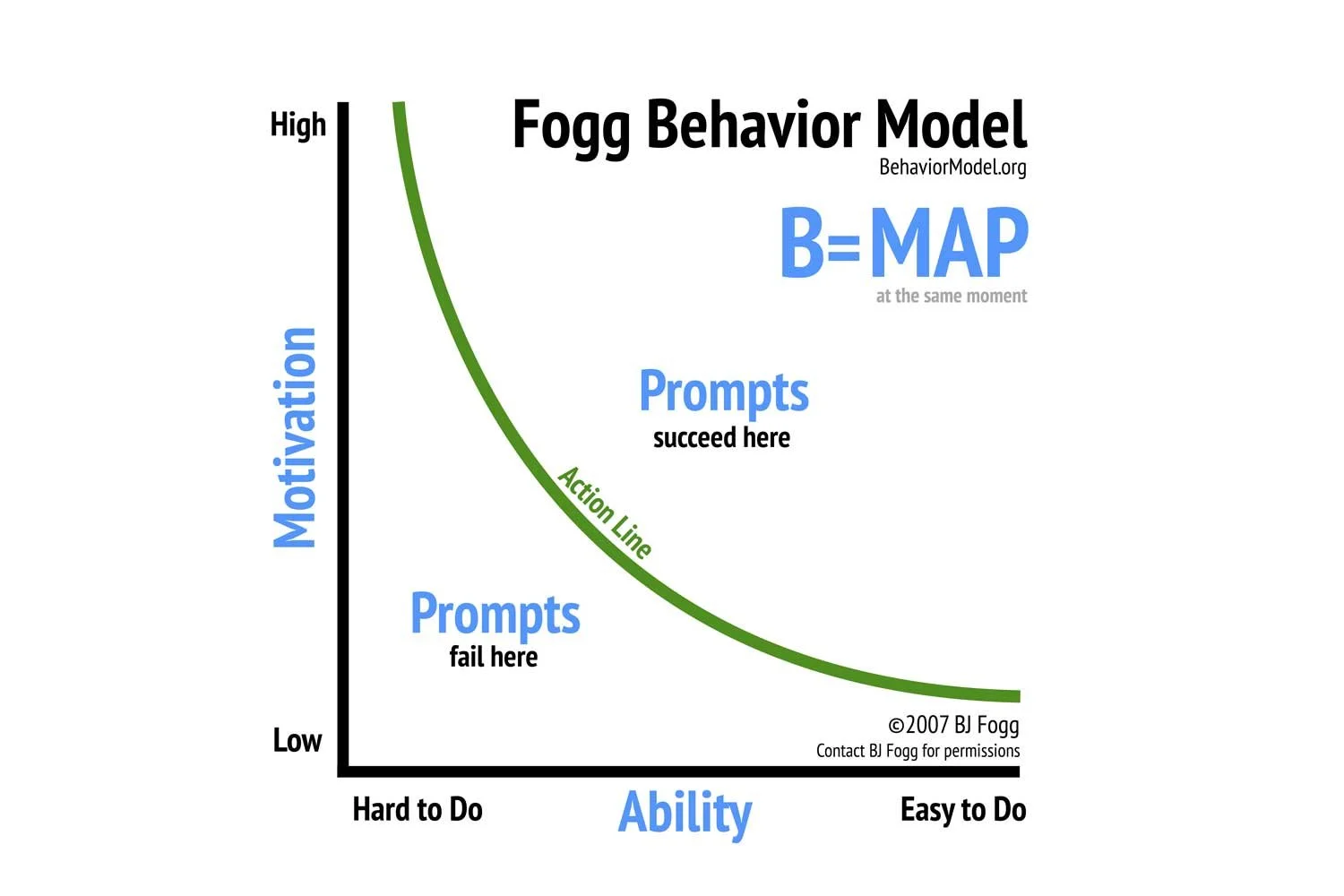

Looking at how people save and build habits

BJ Fogg’s behaviour model was a key piece of research to help us understand the psychology behind building sustainable habits. We used this as a basis to shape our research objectives and to design the savings goals experience in the mobile banking app.

We looked at customer research to identify key motivators

Through looking at existing customer research we identified core customer pain points when it came to savings and key jobs to be done, helping us map key pieces of research to the Fogg behaviour model.

Second to a great savings interest rate – our survey told us 39% want the ability to create multiple saving buckets with customer names and goals and 36% want visualised saving goals (such as a progress bar).

Pain points

Customers want to save but don’t have the time and/or discipline to set up and stick to a savings plan

Customers have a hard time getting into the saving mindset and lack motivation

Customers have less of a need to check their transactions on a savings account and in turn don’t often view progress of their savings goal

Jobs to be done

Help me separate my savings into meaningful goals

Make my money work hard for me and earn more interest/rewards

Help me achieve my savings goals and save more often

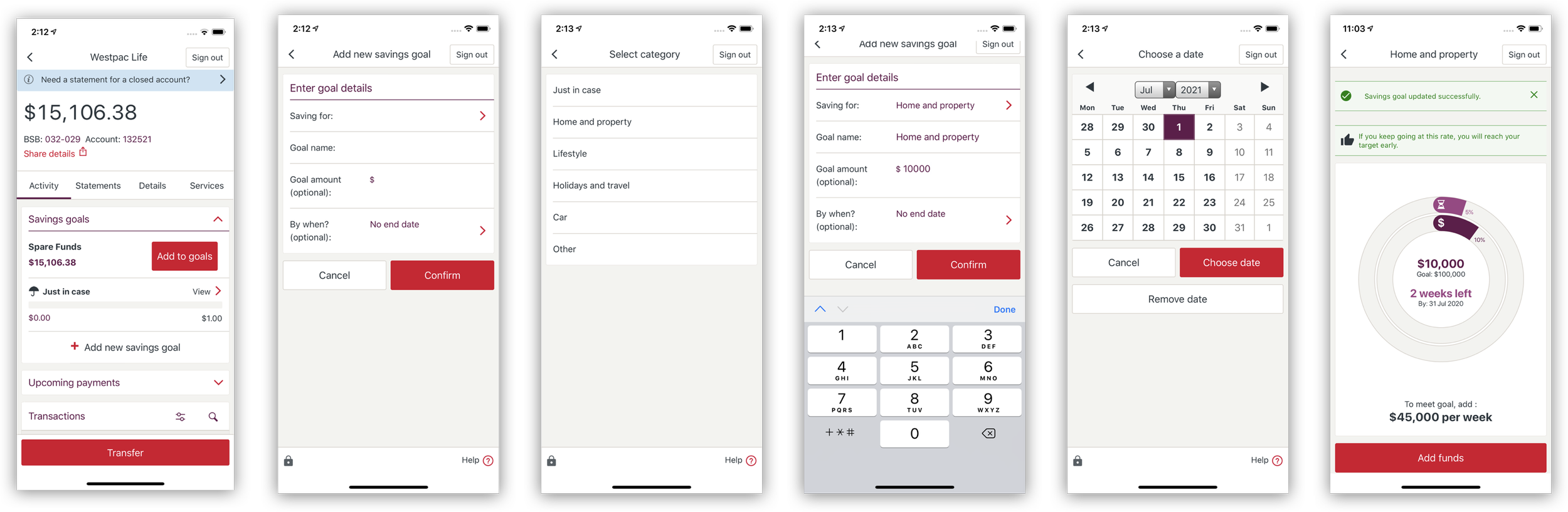

We analysed our current state savings goals in the Westpac live app. Unfortunately there was next to no analytical tagging in the flow to tell us what was and wasn’t working.

How might we enable customers to set up and cultivate a sustained savings habit?

Design iterations and research

We completed 9 rounds of 1:1 customer interviews and usability testing (n = 54 participants) and also performed 1 round quantitative research through an online survey (n = 195). Each time iterating the designs, flows and copy based on customer feedback. We conducted multiple how might we workshops, design jams and copywriting workshops with our internal design team and stakeholders. We also created comprehensive people profiles showcasing their spending and saving habits and understanding their underlying motivations and any hinders to their saving ability.

Design jam sketches

Design exploration for savings goals

Key insights from research:

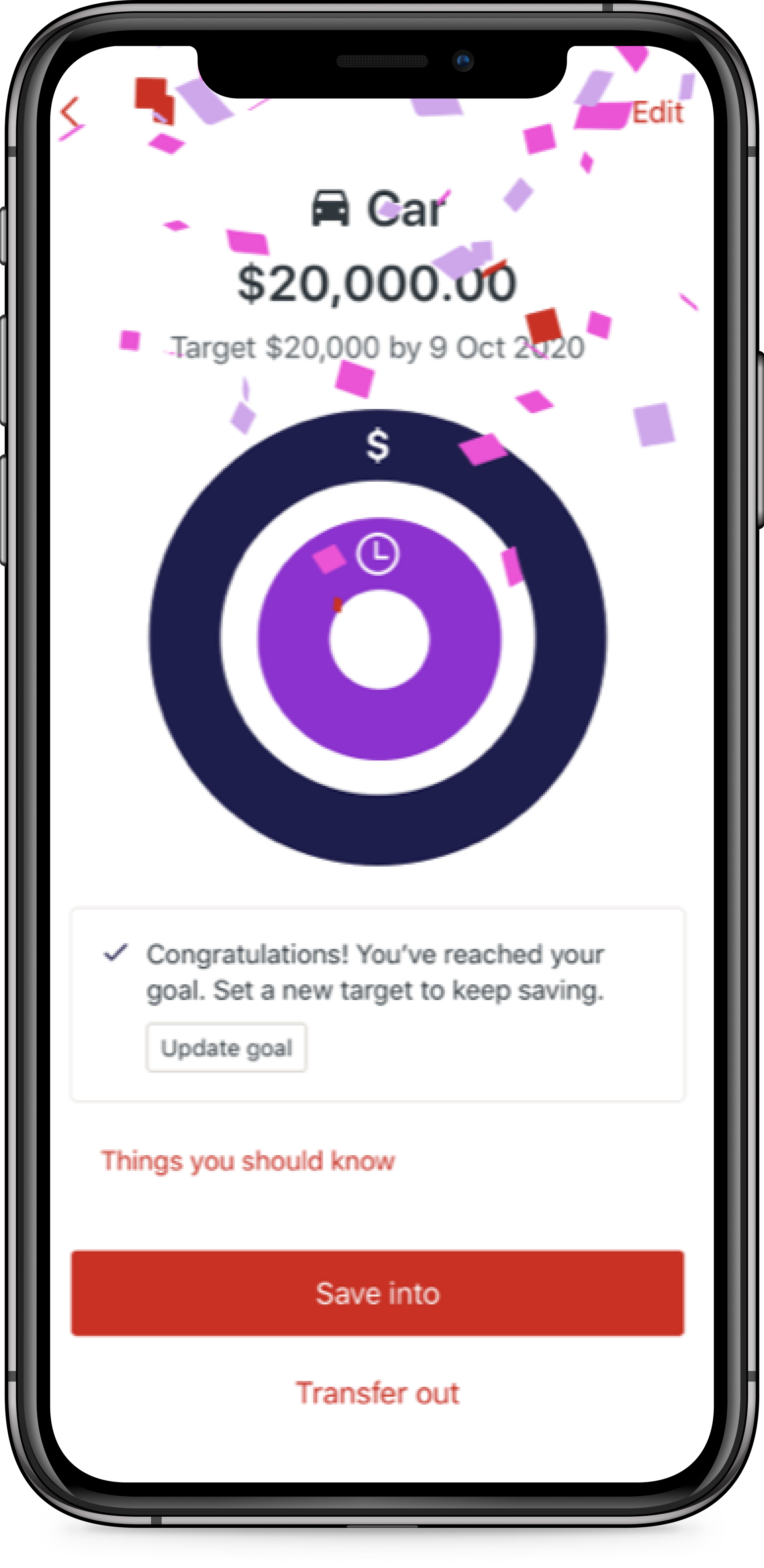

Goal visualisation and celebration is an important aspect in helping customers increase and sustain motivation to complete their savings goals.

Post COVID-19 recurring theme that Australian’s wanted to save more for “just in case” “emergency funds” and have that safety net and security with their savings.

Everyone had different savings goals and levels of control they wanted with their savings and hence goal personalisation was a key aspect that needed to be incorporated into the feature.

$50 was seen as the goldilocks to prompt customers to save and made them feel like they had the ability to do so.

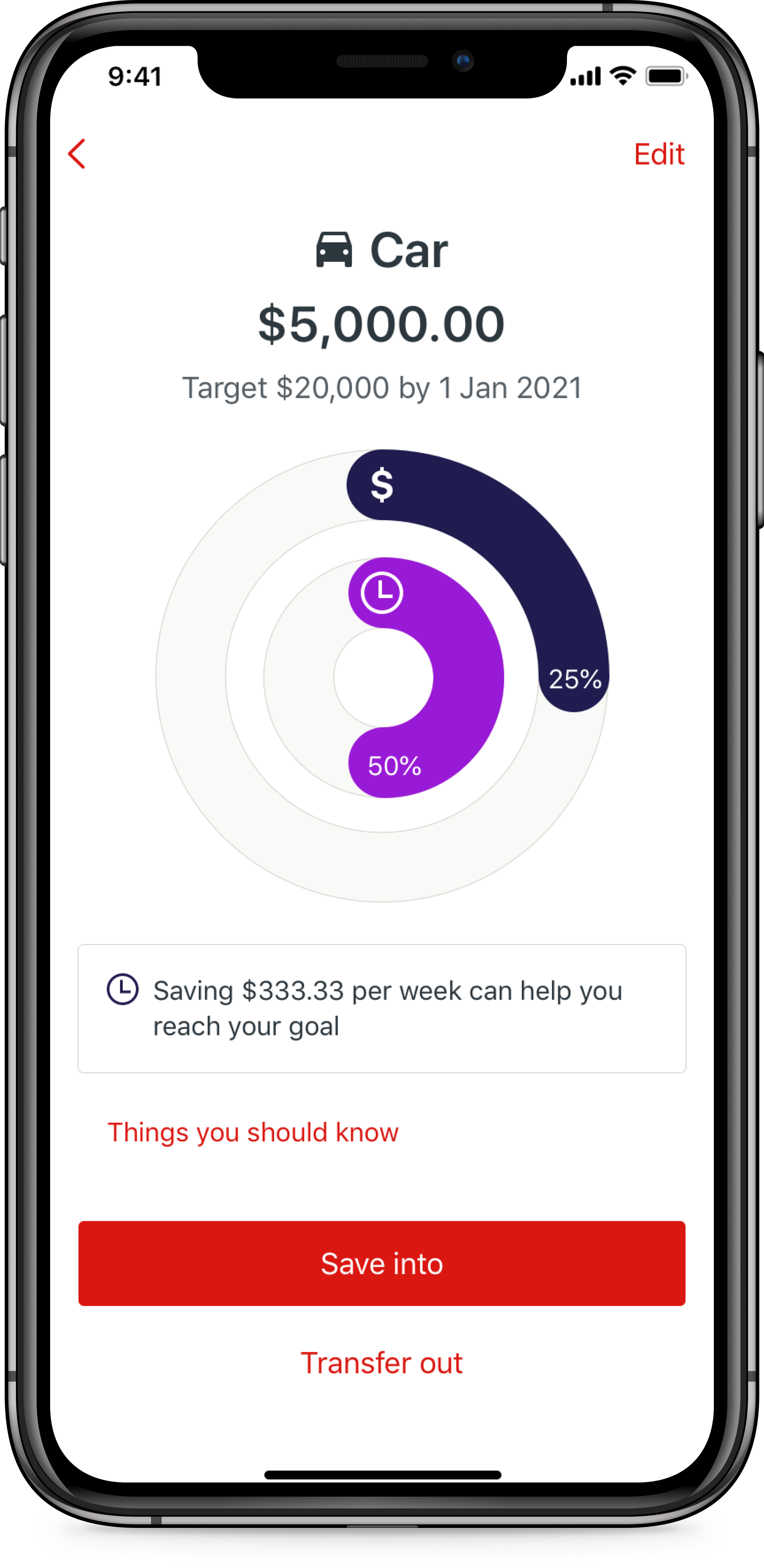

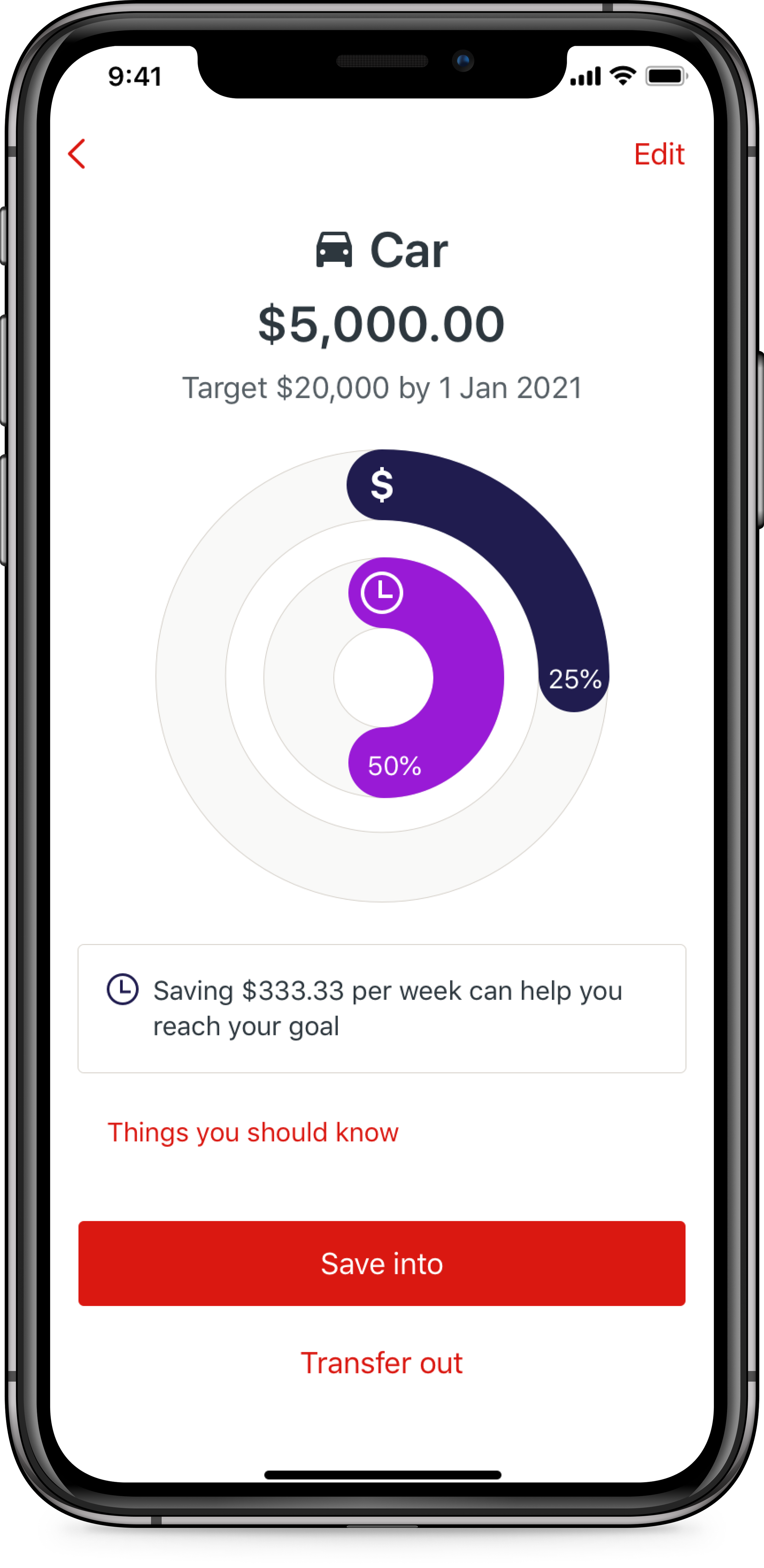

The donut tracker was seen as the most desirable and comprehensive design for customers to track amount and time against their savings goal.

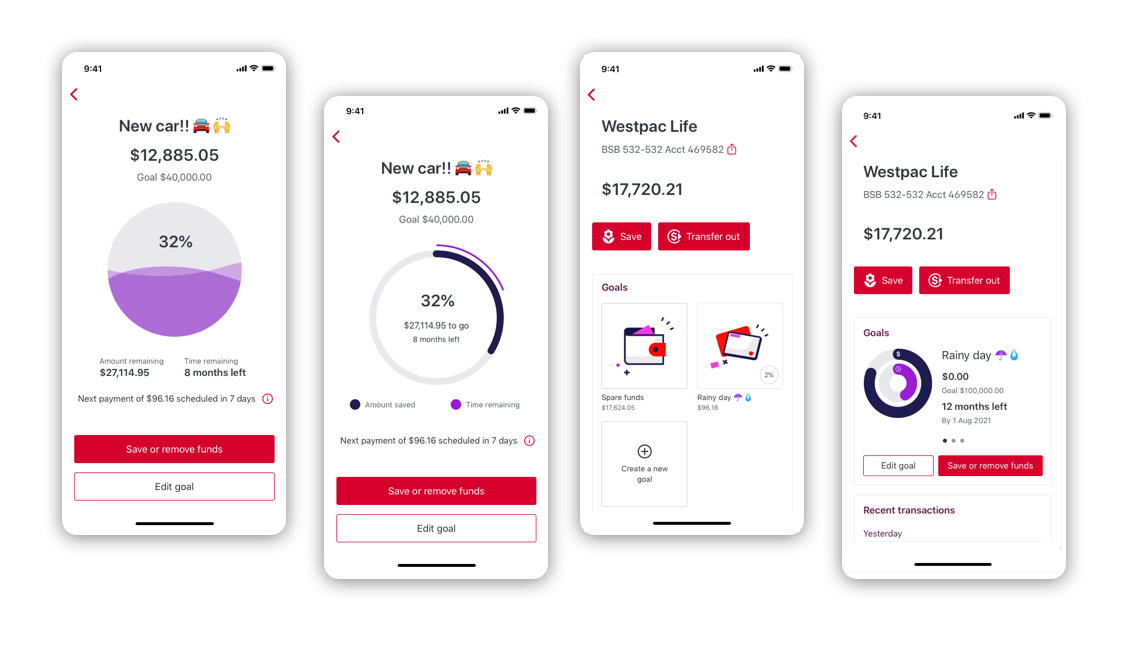

Final designs & key screens

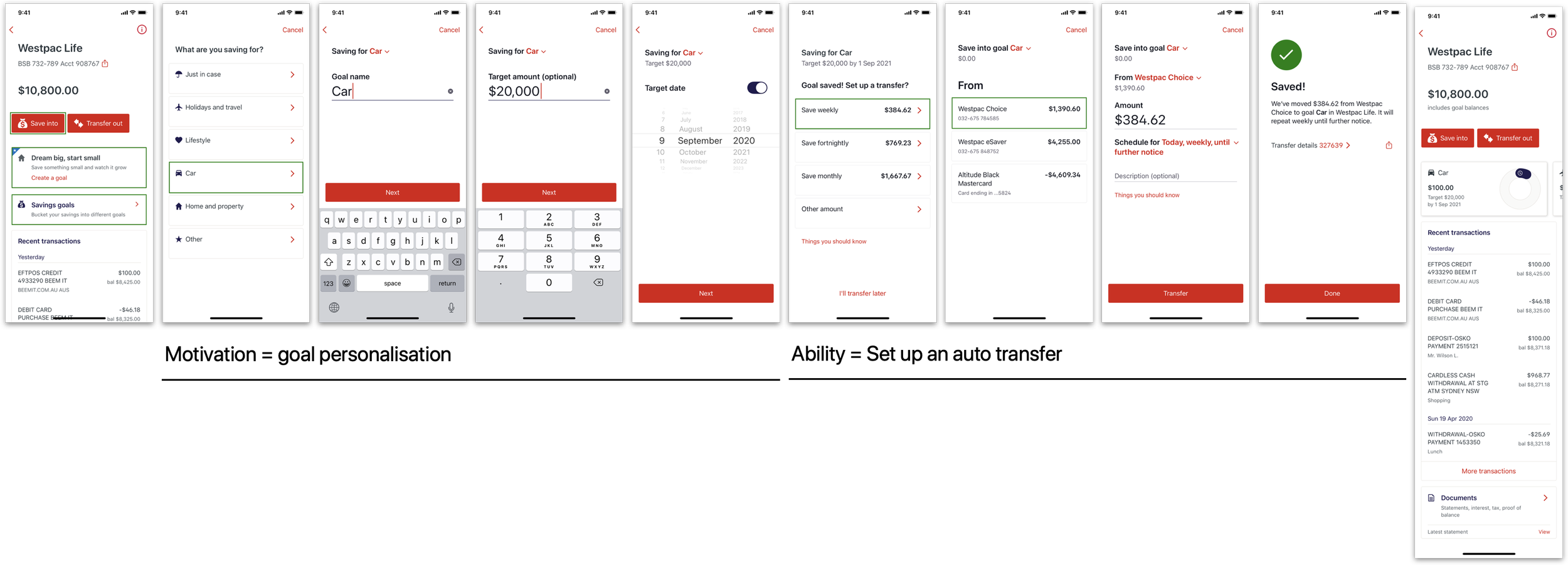

Our savings goal creation flow focused on:

Personlisation of the goal type, name, amount and date

Prompts and multiple entry points

Visualisations to aid goal tracking

Goal visualisation and celebration

Donut tracker for goal amount and time

Contextual prompts to help customers stay motivated with their goal

Quick actions to save into out transfer out of goal

Moment of delight for customers completing their savings goal

Challenges

What’s next for savings goals and habits?

Day 2: Support people to reach their goals and aspirations by saving more

Milestone Celebrations: Additional prompts to encourage customers to keep saving

Quick actions to fund goals: When motivation is high, customers want the ability to transfer money into their accounts quickly and seamlessly

Round-ups: Rounding up day-to-day expenses to the nearest dollar and adding spare change directly into savings

Lack of data from the existing savings goal creation flow

Working within the constraints of legacy systems and platforms

Managing expectations with stakeholders

Day 3: Commit to helping people create a savings habit and new behaviour

Contextual prompts using push and in-app messaging to encourage customers to keep saving

Pay cycle savings: prompt customers to save whenever they get paid into their account

Savings challenge: breaking down larger goals into smaller gamified increments

Learnings

Collaboration is key

Push the boundaries

Adapt and be flexible